In 2021, Catalystas supported our client, a development financial institution, in conducting a market study of four Sahel countries to provide a macro level snapshot of the economic ecosystems and sociocultural constraints facing women, youth, and migrant owned MSMEs, as well as the financial sector and the existing financial services and support structures available to each identified target market. Each country study included five recommendations tailored to supporting our client in carrying forward potential interventions based on internal criteria, local market needs, and the current status of the financial sector as determined by available data.

Access to credit is a critical need, especially when it comes to addressing drivers of instability and conflict in the Sahel region of Africa. Sahelian women, youth, and migrant-owned businesses have some of the highest potential to contribute to the economy, but are often the hardest hit in times of instability. In fact, Catalystas found in this study that access to finance was one of the most significant barriers to enterprise growth in Benin, Burkina Faso, Mali, and Niger, confirming gaps and needs identified over the course of a series of ecosystem analyses and scoping studies we have conducted in the Sahel. Women, youth, and migrant entrepreneurs seeking finance to start or grow a business must overcome additional barriers, including low literacy and numeracy, lack of required identification documents, traditional inheritance laws, stringent risk assessment procedures requiring significant collateral and high interest rates, and cultural norms that place limitations on women’s mobility and interactions outside the home. As such, the overarching objective of this research study was to provide our client with research that would identify and validate promising opportunities for partnering with local, regional, or international financial institutions and targeted capacity development in Benin, Burkina Faso, Mali, and Niger. Specifically, the research study sought to provide insights, analysis, and recommendations that informs our client’s potential intervention and investment plans in the Sahel.

The research study had two aims:

An ecosystem analysis examining the segmentation of the target groups — officially registered MSMEs owned by women, youth, and migrants — as well as their overlap in the investment landscape, including the barriers and opportunities surrounding access to finance and the operation of scalable and effective MSMEs. The ecosystem analysis was paired with market research aimed at defining the top three sectors with a cross over between the highest potential for and number of women, youth, and migrant- owned MSMEs, providing an additional layer of insights into the challenges and opportunities facing these target groups.

An analysis of the local financial sector serving these identified target MSMEs, including an exploration of how they are financed as well as their portfolios, strategies, and products as a means of indicating those best suited to finance women, youth, and migrant-owned MSMEs.

Understanding the challenges involved in lending to these vulnerable groups is essential in designing financial products and services that will unlock the potential of MSMEs to spur inclusive, resilient growth and job creation in the Sahel, while also contributing to Sustainable Development Goal (SDG) 1 — no poverty, SDG 5 — gender equality, SDG 8 — decent work and economic growth, and SDG 13 — climate action. The next section will draw on the lessons learned, opportunities, and context of Benin.

The purpose of our study was to provide our client with a snapshot into the current ecosystem of entrepreneurship for women, youth, and migrants and detailed insights into the opportunities and challenges in Benin, Burkina Faso, Mali, and Niger. To effectively achieve these goals, our multi-country team undertook a four-part research project spanning five months, which included a desk research phase, field research phase, follow-up information collection, and data analysis and triangulation.

In the desk research phase we conducted a macro-level sweep of publicly accessible data and information, aimed at developing an initial understanding and basis of research that would allow the research teams to narrow our scope of focus for strategic data collection during the in-person data collection. Our desk review took a two-pronged approach, focusing on both the market sector research as well as the financial sector research. For the market sector research, we collected macro-level data specifically surrounding the top three sectors or industries hosting the highest numbers of officially registered MSMEs owned by women, youth, and migrants in each country, as well as examining the sectors holding the highest potential for contributions by women, youth, and migrant-owned MSMEs. For the financial sector research, we collected macro-level data regarding the financial situations within each country, looking at central banking authorities, banking associations, microfinance institutions, and national banking associations.

Our goal with the desk research was to identify the key stakeholders in the banking ecosystem of each country, ensuring the inclusion of a diversity of stakeholders – small and medium institutions, institutions serving specific populations, stakeholders in the wider network providing support. The desk research also served to narrow down the scope of our focus when it came to market research, in order to effectively dive deeper into specific industry areas during field research.

During the field research phase, we conducted interviews, focus group discussions, and surveys with industry experts, entrepreneurs, cooperatives, business associations, civil society and non-governmental organizations, small and large financial institutions, and multilateral and international actors in order to capture diverse perspectives and levels of influence when it comes to strengths, weaknesses, opportunities and risks within the market and financial sector. Including a multitude of stakeholders at different levels also ensured a comprehensive understanding of cultural nuance and provided the foundation for our data triangulation, both at the national and regional ecosystem level.

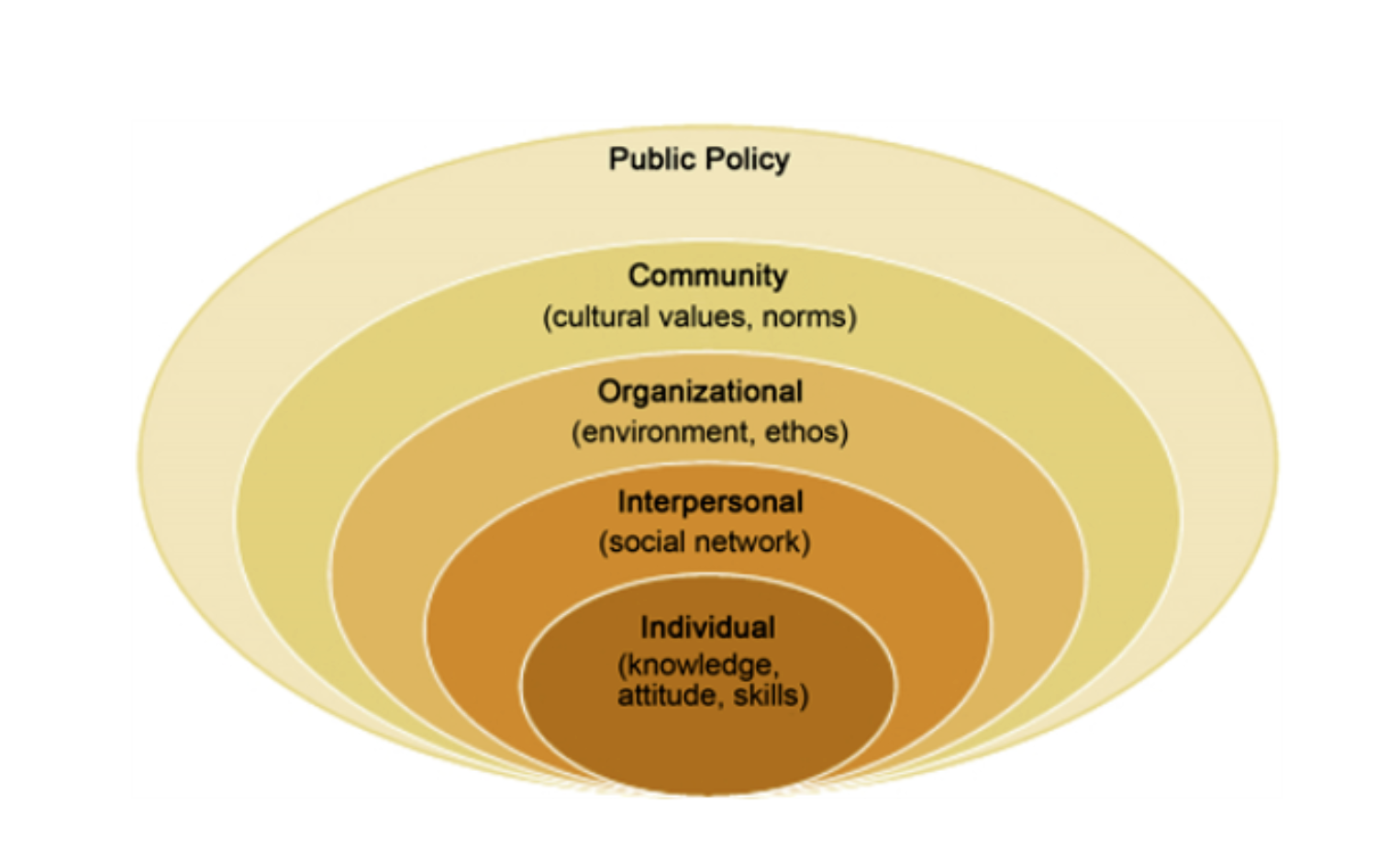

In Benin, we took an ecological approach to understand the challenges and opportunities for our target groups in the financial sector. We began our data collection with conversations from each target group: women, youth, and migrants, aimed at identifying the challenges they experience. While the main industries (agriculture, commerce, renewable energy) in Benin are booming, women, youth, and migrants face specific challenges to participate across the value chains. Cultural social norms and lack of ownership rights dictate the ability of marginalized members of society to obtain the necessary financing from formal institutions to support their entrepreneurial endeavors. As such, the majority of these business owners remain in the informal sector. The stories that were shared during the in-person country research followed the same vein: cultural norms marginalize women, youth, and migrants by limiting their access to the collateral they require to access financial services and support their entrepreneurial aspirations. These marginalized groups typically take smaller loans from social networks and village-based savings and loan associations, and therefore are limited in their ability to scale-up their business activities. Analyzing these stories in real time, we used the data to inform our interview guides for microfinance institutions and larger financial institutions. The stories shared directly from the target groups informed our conversations with the larger structures that dominate the financial sector.

One of the challenges experienced during the data collection phase was the lack of responsiveness of large financial institutions and their availability to share what should have been publicly available data, such as annual reports. As a result of this challenge, and numerous attempts to connect with representatives at banks, we had to adapt our approach to focus our attention on microfinance institutions. This proved useful given that in Benin, microfinance institutions are the institutions that overwhelmingly serve our target groups.

Using the data gathered from the various stakeholders, the information available during the data collection, and reflections with local researchers and banking experts, we drafted recommendations aimed at informing our client about potential avenues for interventions and investments in these burgeoning markets. Our recommendations took a collaborative approach, ensuring that both market research and financial research data was included in each one of the recommendations. We used an ecological approach in our recommendations, ensuring that we tailored all suggestions to include specifications noting the need related to the market, the specific facility that our client could utilize to address the need, and the specific financial institution recommended as a partner(s) in addressing the identified challenges specific to the target MSMEs, COVID-19 response, and Environmental and Social Impact parameters and focuses present in each local market. In this process, we also identified the technical capacity required for the institutions to best support the target groups.

This project reinforced the importance of using an ecological approach in development practice. That is, ensuring stakeholders at all levels are included and understood in the design, programming, and evaluation of any development framework. With so many opportunities in all of these countries, we look forward to continuing to support our clients, whether financial institutions, NGOs, or private sector companies in advancing the development of avenues for economic inclusion and access to finance for all – especially the most vulnerable.

Catalystas Consulting, Lange Voorhout 43, 2514 EC Den Haag, The Netherlands

© Catalystas Consulting. All rights reserved. Privacy and Policy

We built Lysta as an answer to one of our own problems: the need to quickly assemble teams of experts across various subject matter, geographic, linguistic, and thematic areas for projects and proposals as they arise. We quickly realized that we were not the only ones facing this challenge! With the speed that development projects require hiring, turnaround, and technical insights, we see first hand how helpful it is to have a ready-made database of vetted experts to call on.

For existing and potential Clients, you can access all consultant full profiles by signing up here as a client for free.

For consultants, adding your profile to Lysta means jumping to the top of the list for our clients in recruitment processes. We do the heavy lifting: the CV reviews, interviews, vetting, and personnel management; so when our clients come to us, they know they’re hiring someone they can trust to deliver high quality, timely results. Click here to add your profile for review.

We’re proud to be a link in the chain that connects the best of the best – don’t hesitate to reach out and see how you can put Lysta to work for you!